In South Carolina, debt collection is regulated by state laws designed to protect consumers from unfair practices, including restrictions on communication methods and guidelines for enforcing judgments. Debtors have rights to verify and dispute debts, while creditors must follow strict procedures. Avoiding direct contact with law firms through the "do not call" law is crucial for creditors; instead, they should navigate the process through proper administrative channels. Debtors should understand their rights, explore options without aggressive tactics, and be mindful of deadlines to ensure a fair and transparent debt collection judgment enforcement in South Carolina.

“Uncollectable debts can be a burden, but understanding South Carolina’s debt collection judgment enforcement laws is key for creditors. This guide navigates the process, from enforcing judgments to avoiding common pitfalls. Learn practical steps to ensure compliance without resorting to calling law firms. Discover your rights and obligations in this intricate legal landscape. By following these insights, you’ll gain a strategic edge in managing and resolving debts effectively.”

Understanding South Carolina Debt Collection Laws

In South Carolina, debt collection is regulated by state laws designed to protect consumers from aggressive or unfair practices. Understanding these regulations is crucial for both debtors and creditors alike. The South Carolina Debt Collection Act outlines the legal framework for collecting debts, including the do’s and don’ts for collection agencies and attorneys. One key aspect is the prohibition on certain communication methods, such as phone calls to consumers at unusual hours or using deceptive language.

Debtors should be aware of their rights under these laws, which include the right to verify the debt and dispute inaccurate claims. Creditors, on the other hand, must adhere to strict guidelines when attempting to enforce a judgment, ensuring transparency and fairness throughout the process. By adhering to these rules, South Carolina residents can navigate debt collection activities with greater confidence and security, avoiding potential violations that could lead to legal repercussions for collection agencies or attorneys operating within the state’s borders.

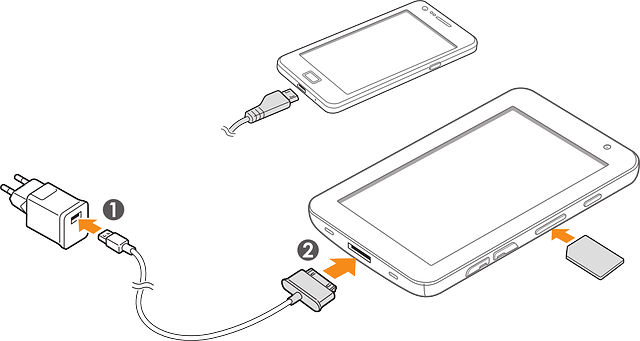

Enforcing Judgments: Steps for Creditors

In South Carolina, creditors seeking to enforce judgments against debtors should follow a structured approach. First, they must obtain a valid court judgment, which establishes the debtor’s liability. Once this is secured, the creditor can initiate enforcement by serving a writ of execution to the sheriff’s office in the county where the debtor resides. This triggers a process that includes seizing and selling the debtor’s assets to satisfy the debt.

Creditors are encouraged to avoid direct contact with debtors, refraining from calling law firms or employing aggressive collection tactics. Instead, they should focus on administrative procedures, ensuring all documentation is accurate and compliant with South Carolina laws. By adhering to these steps, creditors can navigate the enforcement process efficiently while respecting debtor’s rights.

Avoiding Common Pitfalls in Enforcement

Avoiding common pitfalls is key when navigating South Carolina debt collection judgment enforcement. One major mistake to avoid is impulsively contacting law firms, which isn’t always necessary. Many cases can be handled directly through the court system or with the assistance of a local legal aid organization, saving time and money.

Another pitfall involves overlooking important deadlines. Once a judgment is entered, there’s typically a limited window for enforcement actions. Being aware of these timelines and acting promptly can prevent potential legal obstacles down the line. Understanding your rights and options, without relying on aggressive tactics or unnecessary legal interventions, will help ensure a smoother process in South Carolina debt collection judgments.

Your Rights: Navigating the Legal Process

In South Carolina, if you’re facing debt collection judgments against you, it’s crucial to understand your rights and options. The first step is to familiarize yourself with the legal process, which involves understanding the various court orders and notices you may receive. One common practice that many consumers don’t realize is that they are not required to contact or engage law firms directly; doing so is often a marketing strategy used by collection agencies to pressure individuals into paying.

Navigating this process alone can be daunting, but it’s entirely possible with the right knowledge. You have the right to dispute the debt and provide evidence that it isn’t yours or that it has been incorrectly calculated. Legal aid organizations and consumer protection agencies in South Carolina can offer guidance and support throughout this journey, ensuring you remain protected and informed every step of the way.